Wine Investing

Yet there isn’t much consolation to be found in drinking a bottle of wine, no matter how fine, whose value may have plummeted since it was purchased. To avoid this version of humble pie requires very careful planning and an astute understanding of how the international market in fine wine works. For instance, recent years have seen some extraordinary prices paid for headline wines such as Château Lafite but the hype and bluster they attract tends to obscure the fashion-driven roller-coaster that drives these prices.

For a short period Lafite was the darling of Chinese wine investors, buying mainly through auction in Hong Kong, but their tastes can shift rapidly and in the four months after May 2011 the price of Lafite 1982 dropped by about 40 per cent, down from roughly US$60,000 per case of a dozen bottles to about US$40,000. Quite obviously it did not become valueless, it just dropped from an extraordinary, Alice-in-Wonderland, figure to one that was still very high. Those who sold at the height of that market probably made serious money while those who bought certainly have not – so far.

The biggest difficulty faced by most investors in wine is an understandable one: they love the stuff so much that they are unable to make unclouded buying and selling judgements. If you fit into that category then perhaps the safest investment model is that which allows you to drink for ‘free’. In its simplest form this involves buying two cases of a favoured, and investment quality, wine upon release and then selling one of them as the wine reaches maturity, when the price has hopefully doubled or more. This sort of scheme can be set up easily with a reputable merchant who deals in such wines. Storage can probably be arranged through them also and they may even buy your unwanted cases back from you; after all, they know the wines have been properly stored and they haven’t had to keep their money tied up in them.

(Check: www.bbr.com/about/ireland Jessica Lavin: +353 (0)1 677 3444)

A more likely scenario in post-boom Ireland is that wine lovers who bought well in the good times now find that they want to cash in on something that has held its value well, even though it was never seen as an ‘investment’. Thanks to the recent opening of a Dublin office by the long-established auctioneers, Bonham’s, this has never been easier, and this immediately places your wine on what might be termed the ‘world’ rather than the ‘local’ stage. Bonham’s will also accept small mixed lots with greater enthusiasm than say, Christie’s.

(Check: www.bonhams.com/eur/ireland Jane Beattie: +353 (0)87 776 5114)

In conclusion, there is no doubt that good sums of money can be made by astute investment in fine wine but because of this the risks have never been greater. An agreed system of authentication of old bottles is still in its infancy and until this comes about the opportunities for fraudsters are legion. Read on – and then tread very carefully.

BEFORE INVESTING…

Jim Budd is a wine writer of integrity and courage who spends a good deal of his time investigating wine investment scams and publicising details of the activities of the many rogues who seek to make sizeable sums by duping investors out of their money. Nobody should consider investing in wine without having first undertaken a thorough browse of his website: www.investdrinks.org which has been shedding unwelcome light on the fraudsters since 2000. In Budd’s words it, “is dedicated to showing the dangers of drinks investment. To pointing out the dodgy deals.” In the starkest possible terms he states, “You have been warned: fraud is a profitable, low-risk career.” More recently he has added a regularly updated blog: www.investdrinks-blog.blogspot.com

CAVEAT EMPTOR

The huge prices now being paid for a small handful of icon wines have tempted all sorts of shady characters into the market, including forgers and counterfeiters keen to make a quick buck at the expense of gullible wine lovers. Most recently, an auction held in London last February attracted the forensic eye of noted Californian collector and attorney, Don Cornwell. He turned his attention particularly to the wines of Domaine de la Romanée-Conti, Burgundy’s most prestigious producer. In a damning critique, based on an examination of the catalogue, he drew attention to inconsistencies such as the use of four-digit rather than six-digit bottle numbers, incorrect capsules, incorrect glass in old bottles, incorrect use of accents such as ‘^’ and ‘´’ on labels and so forth. As a consequence a baker’s dozen of the lots were withdrawn yet the auction still went ahead. Caveat emptor!

AUCTION MADNESS

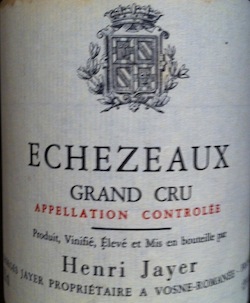

The late Henri Jayer was probably the most fabled winemaker that Burgundy ever produced and his wines now enjoy near-mythical status. Even before his death in 2006 prices were heading into the stratosphere and the US$1,000 per bottle barrier was broken some years ago. But that is nothing compared to the prices paid at a recent auction in Hong Kong where all the wines came directly from the Jayer cellar and hence could boast impeccable provenance. The top lot was a case of Vosne-Romanée Cros Parantoux 1985 that was knocked down for US$266,000 or about US$22,000 per bottle. In all, US$8.5 million was paid for some 740 bottles of wine.

Article originally published in Irish Tatler Man, Spring 2012.